Property By Helander Llc for Dummies

Property By Helander Llc for Dummies

Blog Article

Property By Helander Llc Things To Know Before You Get This

Table of ContentsFascination About Property By Helander LlcThe Only Guide to Property By Helander LlcGetting The Property By Helander Llc To WorkA Biased View of Property By Helander LlcIndicators on Property By Helander Llc You Need To KnowProperty By Helander Llc Fundamentals Explained

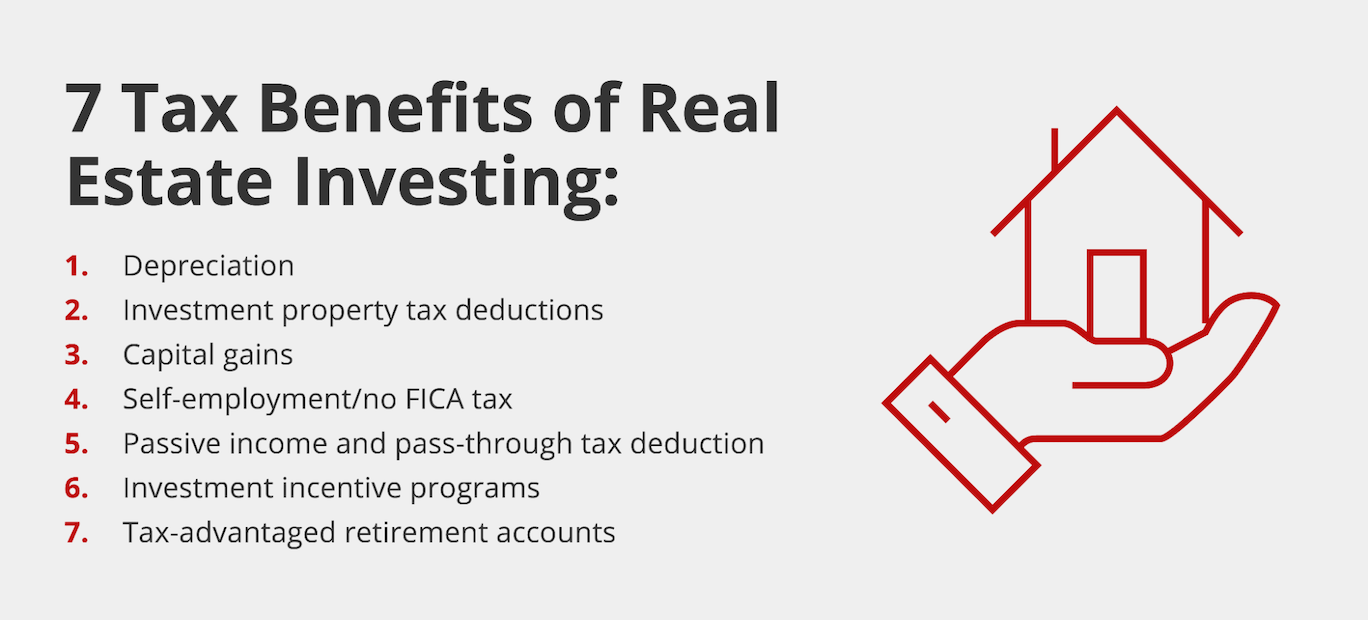

The advantages of spending in real estate are various. Right here's what you require to recognize regarding genuine estate advantages and why actual estate is thought about an excellent financial investment.The benefits of spending in real estate include easy revenue, secure cash money flow, tax benefits, diversity, and utilize. Real estate financial investment depends on (REITs) supply a means to invest in actual estate without having to have, run, or finance homes.

In a lot of cases, capital only reinforces gradually as you pay for your mortgageand build up your equity. Investor can make the most of countless tax obligation breaks and reductions that can conserve cash at tax obligation time. As a whole, you can subtract the reasonable prices of owning, operating, and managing a building.

6 Easy Facts About Property By Helander Llc Shown

Actual estate worths often tend to increase over time, and with a good financial investment, you can turn a revenue when it's time to market. As you pay down a building home loan, you construct equityan property that's part of your web well worth. And as you build equity, you have the utilize to buy more buildings and boost cash flow and riches even much more.

Because realty is a substantial asset and one that can serve as collateral, funding is conveniently offered. Actual estate returns differ, relying on variables such as area, property class, and monitoring. Still, a number that numerous investors go for is to defeat the average returns of the S&P 500what lots of people refer to when they state, "the market." The rising cost of living hedging capability of actual estate comes from the favorable relationship in between GDP development and the need for genuine estate.

The Single Strategy To Use For Property By Helander Llc

This, consequently, equates right into higher resources values. Consequently, property tends to preserve the purchasing power of resources by passing a few of the inflationary stress on renters and by integrating several of the inflationary pressure in the form of resources appreciation. Home loan financing discrimination is illegal. If you think you've been discriminated versus based on race, religion, sex, marriage standing, use public help, nationwide beginning, handicap, or age, there are steps you can take.

Indirect realty investing involves no direct possession of a building or homes. Instead, you purchase a swimming pool along with others, whereby an administration firm owns and operates residential or commercial properties, otherwise has a portfolio of mortgages. There are a number of methods that having realty can navigate to this website safeguard against rising cost of living. Initially, residential or commercial property values might increase more than the rate of rising cost of living, resulting in capital gains.

Buildings funded with a fixed-rate car loan will certainly see the relative quantity of the regular monthly home loan settlements drop over time-- for instance $1,000 a month as a set settlement will end up being much less burdensome as rising cost of living erodes the buying power of that $1,000. (https://www.folkd.com/profile/241347-pbhelanderllc/). Frequently, a key house is not thought about to be an actual estate financial investment given that it is used as one's home

Property By Helander Llc Fundamentals Explained

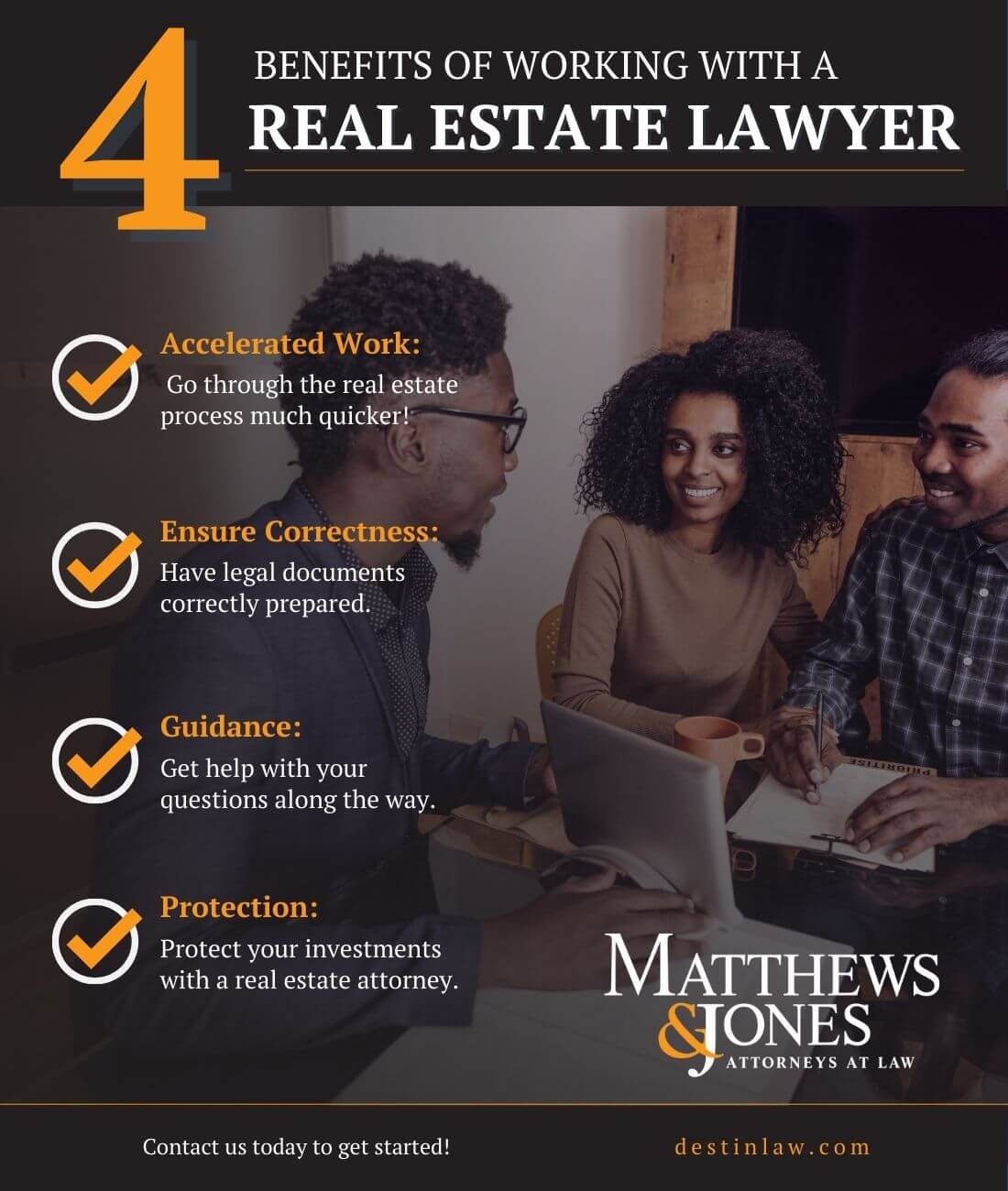

Also with the help of a broker, it can take a couple of weeks of work just to locate the right counterparty. Still, property is a distinctive asset class that's basic to recognize and can improve the risk-and-return profile of a financier's portfolio. By itself, realty offers capital, tax obligation breaks, equity structure, affordable risk-adjusted returns, and a bush versus inflation.

Investing in realty can be an extremely rewarding and rewarding venture, but if you're like a great deal of new financiers, you may be asking yourself WHY you ought to be investing in realty and what benefits it brings over various other financial investment possibilities. Along with all the fantastic advantages that go along with spending in real estate, there are some drawbacks you require to think about also.

The Greatest Guide To Property By Helander Llc

If you're searching for a method to buy right into the genuine estate market without needing to spend hundreds of thousands of bucks, have a look at our residential properties. At BuyProperly, we use a fractional ownership version that permits capitalists to begin with as little as $2500. An additional significant benefit of realty investing is the capacity to make a high return from purchasing, refurbishing, and re-selling (a.k.a.

Some Known Questions About Property By Helander Llc.

If you are charging $2,000 rental fee per month and you sustained $1,500 in tax-deductible expenses per month, you will just be paying tax obligation on that $500 earnings per month (Homes for sale in Sandpoint Idaho). That's a big distinction from paying taxes on $2,000 monthly. The revenue that you make on your rental device for the year is thought about rental revenue and will certainly be exhausted appropriately

Report this page